This page details the process for confirming verbal Gift Aid declarations. If you have a written and signed Gift Aid declaration see “Confirming Written Gift Aid Declarations“.

Sending a Gift Aid declaration confirmation letter

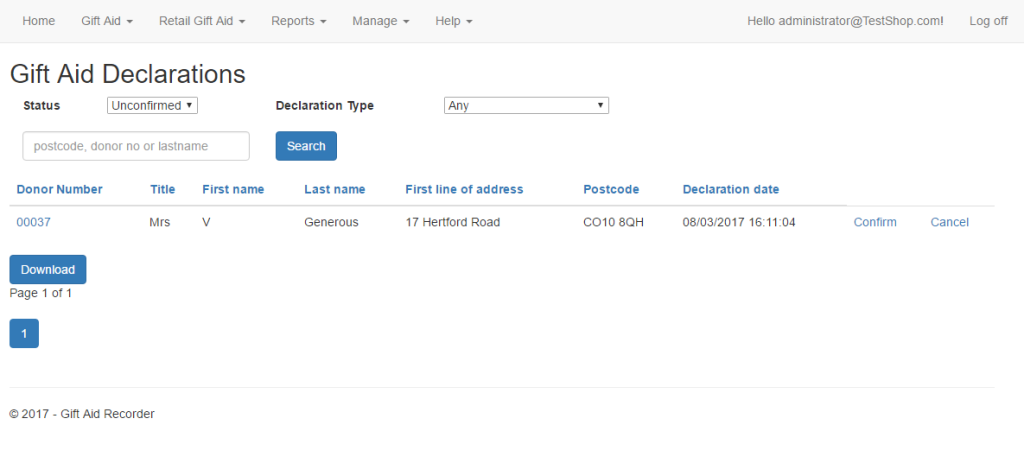

To confirm a Gift Aid declarations use the menu system to navigate to Gift Aid – Gift Aid Declarations.

Select “Unconfirmed” in the status field and click “Search” to filter the list to show unconfirmed declarations only.

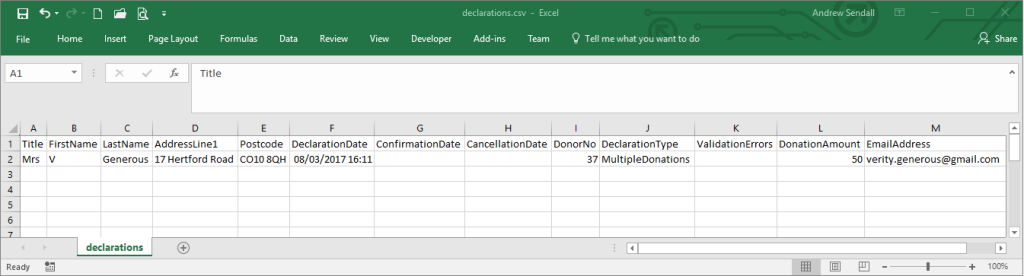

Click “Download” to download csv file containing the filtered list of Gift Aid declarations.

The downloaded csv file can be used to provide data for a mail merge using Microsoft Word or other compatible word processing and email applications.

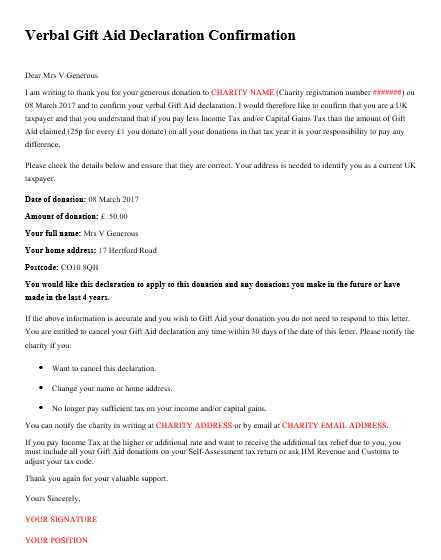

Download the sample “Verbal Gift Aid Declaration Confirmation” letter template for MS Word. Open the template in MS Word and change the text highlighted in red to reflect your charity details and then save it in your personal templates folder.

Use the template to create a new “Verbal Gift Aid Declaration Confirmation” letter. From the “Mailings” tab use the “Select Recipients” tool and choose “Use an existing list…” to bind the mail merge document to the csv file listing unconfirmed declarations which you downloaded from Gift Aid Recorder.

You can now print or email confirmation letters directly from MS Word.

Confirming Gift Aid declarations

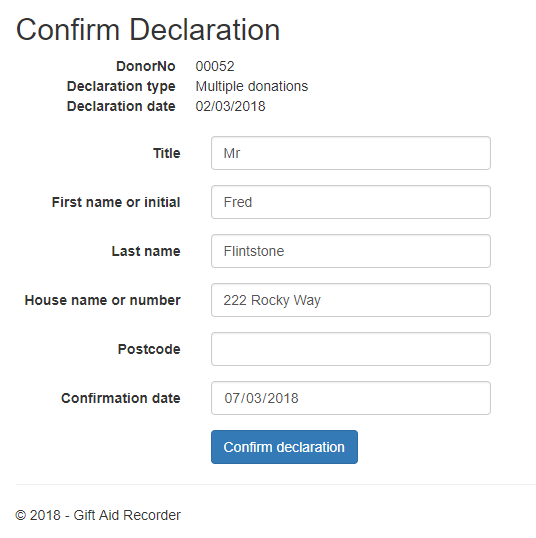

Once you have posted the letters / sent the emails return to Gift Aid Recorder to confirm that the confirmation letters have been sent. Using the menu system navigate to Gift Aid – Gift Aid Declarations. Use postcode, donor no or last name search to locate specific declarations. Click “Confirm” and on the resulting Confirm Declaration page review the donor details. The confirmation date should be set to the date the confirmation letter was sent. Click “Confirm Declaration” to confirm the Gift Aid declaration.

Note: Once you have confirmed a Gift Aid declaration you are entitled to claim Gift Aid on donations covered by the declaration. However a donor is entitled to cancel their declaration within 30 days of the date of the written confirmation. Therefore you should avoid submitting a claim until the 30 day period has expired.

Note: The csv format is also compatible with Microsoft Excel and other spreadsheet applications.